A recent survey conducted by the Center for the Study of Student Life at The Ohio State University uncovered some unsettling statistics regarding student financial stress, as well as some hopeful statistics about the impact which financial literacy has upon this stress (Ohio Student Financial Wellness Survey - September 2011).

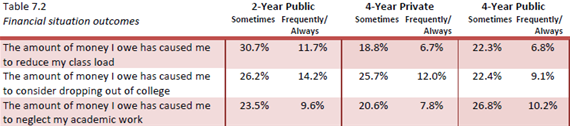

It is widely documented that college costs are on the rise, but few studies exist to document what effect this is having on students. It turns out that today's cost of education and increasing debt levels have students weighing some very drastic decisions. At 4-year public universities, 26.8% of students report that the amount of money they owe has caused them to neglect their academic and 22.4% have actually considered dropping out of college because of their debt (see chart below).

|

Bryan Ashton, Program Coordinator for Financial Wellness at The Ohio State University, was also concerned about some other responses from the survey. "We see over 50% of Ohio students worry about being able to pay monthly expenses and over 36% of students having a large or extreme amount of stress due to finances" said Ashton. When asked about how the school plans to address this concern, he said that "We are looking at new assessment to see if budgeting education or other forms of financial literacy can help to reduce this stress."

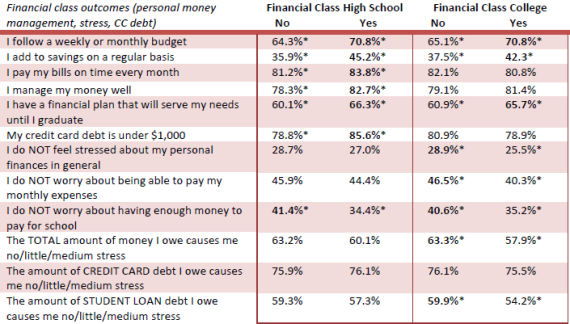

Could financial literacy education be the cure for these alarming responses? The survey had some interesting statistics which give us hope. When comparing students who had received a financial literacy education in college versus those that hadn’t, the former group had lower percentages affected by financial stress on every question asked (see chart below).

Whether financial literacy is the cure will likely be answered in the next 5-10 years, as hundreds of colleges have already set up financial literacy programs or contracted with financial literacy organizations.

If you are a school administrator and are interested in using iGrad's financial literacy platform at your college, find out more by clicking one of the options below:

Watch our demo video

| or | Contact iGrad for questions or school testimonials

|