On the heels of a recent PISA report, which states that young people in the United States are below international averages in terms of financial literacy, the U.S. House of Representatives has taken quick and decisive action to help improve young people's financial literacy in one, key area—college loans.

The Empowering Students through Enhanced Financial Counseling Act (or H.R. 4984) passed through Congress last Thursday by a vote of 405-11. Aimed at providing both students and parents with the knowledge and tools they need to effectively pay for college in the twenty-first century, this bill has a lot of great features, but will they be enough?

[Read: Education Department to Ease Student Loan Rules]

The Details of H.R. 4984

As its name suggests, counseling college-aged students through the financial aid process is an important, universally recognized way to empower them by helping them not only complete their education but stay above water financially following graduation. Although many colleges already provide some degree of counseling for their students, this bill would mandate that counseling and set new precedents for who receives it and when. Some important highlights of H.R. 4984 include:

- Mandatory financial counseling for both students taking loans and parents taking loans on their students' behalf. Counseling would be specific to the party's financial position and be more than a simple read-through brochure—an interactive experience.

- In addition to counseling, colleges and the federal government will conduct awareness and outreach programs informing students and parents about the obligations of both federal and private education loans over time.

- Each year a student/parent takes an educational loan he/she will be required to acknowledge this financial risk by giving consent.

- Students receiving Pell Grants will receive annual counseling regarding the specific obligations of this program. As all Pell Grant recipients are low-income students, this will include information and support in following through with the terms and conditions of Pell Grants.

- The U.S. Secretary of Education will develop and administer an online counseling tool that consumers have tested and approved for colleges to use alongside any private loan counseling programs. This tool is to include all aspects of financial counseling obligated by the bill including annual renewal counseling, exit counseling, and Pell Grant counseling.

Implications for the Future

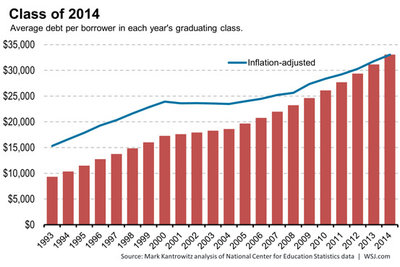

While the passage of H.R. 4984 marks a huge step in the right direction at the national level for financial literacy education, there are many lingering problems in relation to the rising costs of college and what can be done at a federal level to make attending secondary institutions more attainable for low- and middle-income students.

H.R. 4984, a bipartisan bill, moved through the House at lightning speed. Introduced at the beginning of June and sent to committee by the beginning of July, it passed in less than two months on July 24. This clearly signals a universal acknowledgement of the need for financial literacy education and accountability for young people and their parents. Yet, as the Obama Administration points out, there is worry that H.R. 4984 only bandages the larger issue—rising college costs.

The White House, along with many others within higher education and the government, has rightly pointed out the problem with bills like H.R. 4984. Though it is a step in the right direction, all the financial knowledge in the world cannot help those without the means to afford an education, even with the help of loans. As education at private institutions especially reaches into the hundreds of thousands of dollars, the inability of many families to even fathom such a financial obligation continues to leave able-minded students from low- and middle-income homes at a decided disadvantage as they continue to limit their college choices—not because of their abilities, but because of their wallets.

Realizing the need for increased student financial education, iGrad teamed up with best-selling author Sharon Lechter and Pay Your Family First to produce an innovative financial literacy course which utilizes the increasingly popular "flipped classroom" model. The course, entitled Your Financial Mastery, is a prime example of the type of resource H.R. 4984 requires and covers all of the Core Competencies established by the Department of Treasury.