Recently the Department of Education launched a new initiative to study effective ways to counsel students about their student loans. The initiative promises to track several schools' approaches to financial aid counseling.

Student loans collectively top one trillion dollars. According to the Washington Post, over 11% of students default on their student loans. Schools with higher default rates face sanctions and repercussions from the Department of Education such as heavy fines for misrepresentation or even being shuttered. The new study looks at the unique approaches to loan counseling and student engagement at 51 schools covering a range of institutions: two and four years, profit and nonprofit, public and private.

The Key: Withholding Funds

Currently, federal standards require all student borrowers to complete entrance and exit loan counseling. The type of counseling is up to the school to decide with an emphasis on in-person or cost-effective online resources; however some schools have even sent out the financial aid information via mail. The Department of Education provides a substantial list of information required to be passed on to the student. Much of the information is simply repeated at both sessions with more emphasis on repayment in the exit counseling session.

Presently, the law hampers institutions from withholding funds to students if they have completed the federally-mandated entrance loan counseling. Although further counseling or education might be available it is purely voluntary. The experiment hopes to study the effectiveness of requiring additional counseling or financial education and allowing the schools to withhold funds as a result.

Forgettable Financing

Surveys by both the Young Invincibles and The National Financial Capability Study (NFCS) suggest the existing loan counseling experience is lacking. Although students may have participated in the mandatory counseling 40% claim they do not remember it, according to Consumer Report. Furthermore, the NFCS Survey found that over 54% of student borrowers were unaware of what their monthly payments would be on their upcoming loan.

The experiment from the U.S. Department of Education focuses on borrowers who have already completed the previously required counseling. They outline taking a subset of borrowers from each institution and dividing them into two groups; one will be required to have additional counseling (prior to funds disbursement) and one will be required to have no more than the previously required counseling.

Institutions which have offered additional counseling resources may continue to do so on a voluntary basis. Schools which have not investigated further educational or counseling options are restricted from starting those programs until the experiment is ended in a few years.

School’s Choice: Content and Delivery

Each school is given their choice about the additional content and mode of delivery among: the Department’s own “Financial Awareness Counseling Tool”, the school’s own alternative counseling resources, or tools from a third-party, like iGrad. For instance, the University of Delaware points students to the Department of Education’s entrance loan counseling site. Alternatively, Arizona State University offers a wide variety of calculators and entrance counseling is done through iGrad’s financial wellness platform.

Through an independent survey iGrad (which is functioning as the financial education platform at three of the 51 participating schools) determined that students were both more engaged and retained more information when going through interactive video student loan counseling, as opposed to the Department of Education’s text-based loan counseling.

"The current entrance counseling process involves students completing the Department of Education's online entrance counseling session once, as a condition for receiving their first student loan disbursement. The website contains very important information to guide students in understanding their rights and responsibilities, but the problem is the mode of delivery." said Clemente P. LaPietra, Executive Director of the Office of Loan Management at Monroe College (which has been chosen for the experiment). He continued, "The session has a lot of text and very few graphics. We've observed that students tend to prefer short videos, such as the ones that iGrad features on their courses, to text-laden presentations. This negatively affects their retention of the counseling information."

While content is up to the schools, the Department of Education recommends the following topics (among others) to be including in the “additional counseling”:

- Comprehensive information about the terms and conditions of Federal student loans.

- A reminder that students will be required to repay their loans even if they do not complete the academic program

- Information that indicates that completing an academic program will increase the students’ ability to successfully repay their loans

- Comprehensive information about Direct Loan repayment options and forgiveness benefits

- A reminder with information about free assistance with Federal student loans including:

- Loan consolidation

- Rehabilitation

- Participation in income-driven repayment plans

Next Steps: The Webinar

The participating schools and the Department of Education will engage in a webinar mid-January to further outline the details of the experiment and the responsibilities of the participating schools.

The webinar is being held on January 18, 2017 from 1:30 - 3 PM (EST). To register click here.

Conclusions

As stated in the Federal Register “The additional counseling is expected to help borrowers better understand repayment options and obligations and make more informed decisions about their debt.”

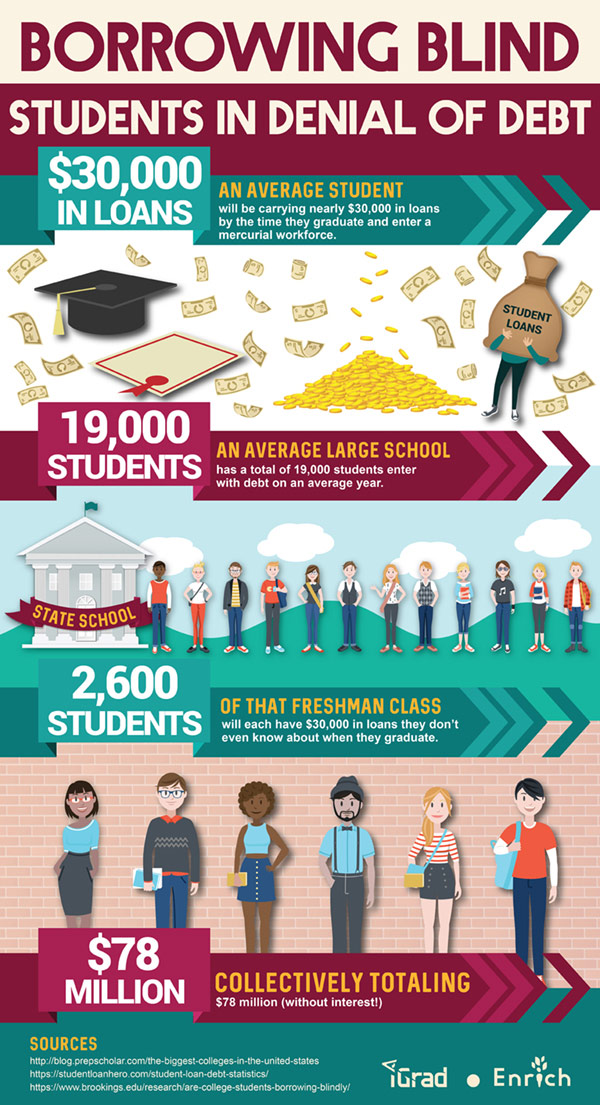

According to a survey from the Brookings Institute, 28% of students with federal loans claimed they didn’t have federal loans and 14% claimed to have no debt at all.

You might be asking yourself "how important is this?" Why would the Department of Education really concern itself with this? To put the initiative in practical terms:

The idea that any person could garner significant debt without being aware of the terms and/or the debt itself is the driving impetus behind the Department of Education’s experiment over the next several years.