Image Courtesy of: Bandita

Study validates the effects of well-implemented financial literacy programs on young adults.

Financial literacy is quickly becoming a skill necessary for leading a financially stable life. While pre-existing research indicates areas of concern when it comes to financial literacy, there is still widespread skepticism about effective ways to attack this growing pandemic. Earlier generations operated under the belief that discussions of finances should be kept private, resulting in a knowledge gap that has left millennials navigating through the muddled waters of money management. With the cost of education on the rise, a growing need for a college degree, and easy access to debt via credit cards and personal loans, young adults are faced with the consequences having poor financial awareness.

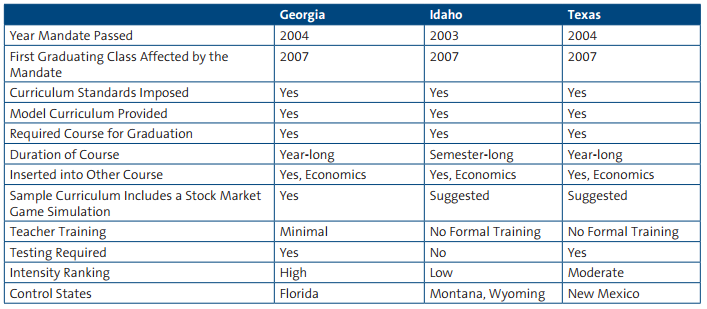

Fortunately, several states have enacted legislation mandating financial literacy programs in high schools. These mandates have been implemented in an effort to address low levels of financial literacy amongst the nation’s youth and help educate them about money management. A recently published study by the Financial Industry Regulatory Authority (FINRA) highlights the effect of these mandates on credit scores and delinquency rates among young adults, ages 18-22, in Idaho, Georgia, and Texas.

Earlier studies on financial literacy produced questionable conclusions due to data or methodical discrepancies, like failure to consider other curriculum changes passed in congruence to the financial literacy programs they examined. The research presented by FINRA not only assures that the mandate was the sole curriculum change in the state that year, but also considers the timing of implementation and the degree to which the programs were executed.

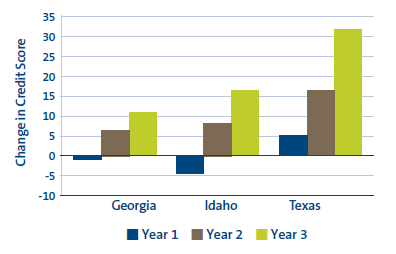

The study tracked the average change in credit scores for the first three years after the programs were implemented. After year one only Texas showed improvements. Years two and three were more promising, however, as all three states showed sizeable improvements, with the most significant increase coming after year three. Georgia showed an increase of 10.89 points, Idaho improved 16.19 points, and Texas, which had the biggest increase, improved by 31.71 points in comparison to pre-implementation averages.

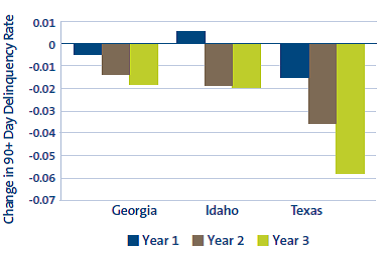

Similarly, 90+ day delinquencies didn’t do too well after year one, but by year three Georgia saw a drop of 9.9 percent from pre-implementation levels, while Idaho experienced 15.6 percent decrease. Again, Texas saw the biggest change with a 32.6 percentage point difference from pre-implementation levels.

The numbers bode well for the state of Texas as their method produced the best results. But what makes them unique? After all, they had moderate intensity and didn’t train their teachers. Some might argue that their year-long course was the reason, but the same argument could be made for Georgia, who, while producing positive results over a three-year span, actually displayed the smallest improvement. One possible reason is that Texas imposed more standards than Idaho and Georgia while tailoring their curriculum to teach more relevant material like impact of bankruptcy, saving for retirement, types of loans available to consumers, and money management in the context of transitioning from renting to owning a home. Georgia on the other hand, focused one of its standards on “relating changes in monetary and fiscal policy to individual spending and saving.” It’s not a bad standard but perhaps high school students, particularly those headed to college, would benefit more from learning about loans available to consumers.

Want to know how colleges are implementing financial literacy programs?

Download one of our financial literacy eBooks to find out!

|

Financial Literacy Initiative

|

Compendium

|

This brings up an interesting point when it comes to financial literacy programs. Beyond just the numbers, FINRA’s findings give us insight as to what type of material schools should be teaching their students. Young adults, whether working professionals or college students, might be better served learning about loans, budgets, buying a home, or even saving for retirement than learning about policy changes in Capitol Hill. While it’s important for students to know that congress extended the amount of time a loan could be delinquent before entering default status, none of that information even matters if they don’t first understand what delinquent and default mean.

While the research clearly shows the positive impact these programs had on both credit score and 90+ day delinquencies, some might argue against FINRA’s findings. The study uses a small age range and doesn’t consider other variables that young adults face in building and maintaining credit. Notably, positive financial behavior does not immediately affect an individual’s credit score, but rather takes time to have a meaningful impact on one’s risk profile. Because the sample set is limited to young adults between the ages of 18 and 22, it is difficult to determine the long-term effects of these programs. It must be taken into consideration that substantial changes to credit scores or delinquency rates may be challenging to see clearly over a short duration with such a young population, especially in comparison to other young adults with similarly short credit histories.

The data presented show clear progress in young adults who are exposed to financial literacy education as a curriculum requirement, and, “notable improvements in credit outcomes for young adults who take personal finance courses in high school.” Although the full effect of state mandates for financial literacy education cannot be known at this time, the positive impact these requirements are having on students’ credit behaviors is apparent. In order to help address the negative consequences of financial illiteracy among young people, the problem must be dealt with in the classroom.

Several states have gone ahead with their own financial literacy mandates. Arizona State Senators voted 25-5 on SB 1405 last Thursday. The Bill would require high school students to prove their competency in personal finance as a part of their social studies requirement before graduation. The State Board of Education would be responsible for creating a course that teaches students how to prepare financial statements and personal budgets, how to identify college funding resources, understanding credit scores and reading credit reports, as well as introducing them to entrepreneurship. Kansas has also crafted their own version of a financial literacy mandate. HB 2232 would require a course for grades 11 and 12 before graduation. Grades K-10 would have financial literacy standards incorporated into their math curriculum.

Not every state is taking part in tackling this issue at the high-school level—an issue that is clearly reflected in higher education where students are accruing record debt. The rising cost of education coupled with growing debt is not only affecting young people; it’s also affecting the perceived value of higher education. This is a problem that, if unaddressed, can affect retention rates, alumni donations, and even the appeal of pursuing higher education.