The twenty-first century learner is a blend of knowledge, literacies and skills. With widespread access to the internet and light-speed technology, a proper education is no longer just the acquisition of facts. It is an experience that seeks to equip learners with the ability to think critically, solve problems creatively, and apply what they learn across real-world experiences.

With so big a task, emphasis is shifting from a one-size-fits-all education system to one that focuses on a person's unique ability to learn. By assessing individuals based on end-results rather than delivery, you're giving them the flexibility to find solutions in a way that's conducive to their unique learning style. New learning models are being applied to everything from employee wellness to financial education.

Game Based Learning (GBL) is one of these models. It combines evidence-based instructional strategies, multimodal delivery of content, and game constructs into one experience. “In game-based learning, players are granted access to the affordances of games to understand concepts or critical processes.” GBL lends itself to gamification, a popular technique used by health & wellness apps like Nike+ Running or myfitnesspal, which assist in developing systems of motivation and schedules of reinforcement through real-time tracking and analysis.

Unlike gamification, GBL is not seeking to modify behavior only within a game context. “Gamification can be powerful for that small area when desired behavior change only requires incentives but for all of the rest of the desired learning and behavior changes, game-based learning is more appropriate.” says Dr. Barbara Chamberlin at New Mexico State University. The goal of the GBL is to transform the user and influence future decisions. “Ideally, in a game-based learning environment, learners would come to understand why behavior should be changed, practice doing so in an expedited or more accessible way (hard to practice saving for retirement over a 30 year process, so easier to do when time is sped up in a game) and understand concepts that are difficult to learn other ways.”

Why do Game-Based Learning Systems Work?

The game environment is a safe place where learners can be taught desired content and given the freedom to evaluate other outcomes. When properly designed, this exploration allows learners to come to the correct conclusion through guided discovery. This shapes behavior so that desired behaviors are acquired and generalized and undesired ones are identified and phased out.

On top of acquisition and generalization, games operate as tools that facilitate reflection, illuminate patterns of thinking and foster discussion. When a decision is made or a stance is taken in relation to certain information, learners are able to face their own assumptions, which serves as the first step in changing long-term behavior patterns. Learners are also able to review, process and relay information in their own way, improving their ability to more readily recall and evaluate the information in new situations.

GBL and Financial Literacy

With student loan debt exceeding 1.3 trillion dollars in recent months, it is important for students to understand the impact of their financial decisions. This understanding cannot be fully realized without a level of financial literacy that allows individuals to understand core terms, concepts and dynamics.

In the past, critics of financial literacy education have argued against its efficacy—claiming that it doesn't work because anything we're taught in class, we forget soon after the bell rings.

JD Roth, editor of the website Get Rich Slowly: Personal Finance That Makes Cents, doesn’t “think this country needs more financial literacy education. Time and again, financial literacy efforts have failed…when I was in high school, all seniors were required to take a financial literacy class. It covered topics like compound interest, the Federal Reserve, how to write a check, and the dangers of credit cards. I took that class. I aced every test. And five years later, I had the beginnings of a debt habit.”

Perhaps the problem isn't in the content but in its delivery. A recent FINRA study shows that financial literacy education, if well implemented, can yield positive results. Roth, an advocate of behavioral finance, believes that “behavior is more important. Building a better budget isn’t going to change your attitude toward saving and spending; but changing your attitude toward saving and spending could very well lead you to building a better budget.

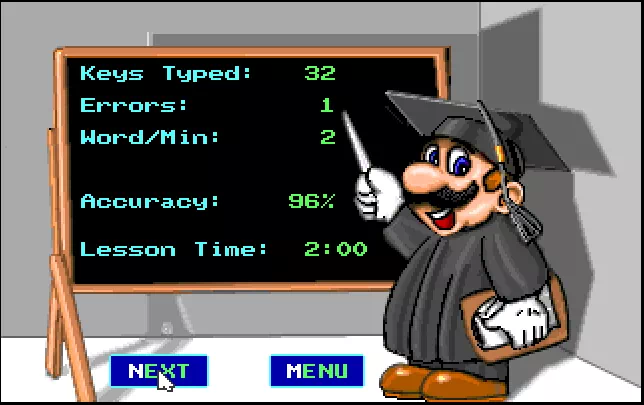

GBL is the two-pronged solution to this problem, as it integrates both financial and behavioral literacy education into a single game. It structures financial content in levels of increasing complexity, so that each one draws from and builds upon prior concepts and knowledge. Game design leverages motivation against the challenge of new information. The game context allows for practice and feedback that seeks to be more encouraging than punishing. When learners are achieving -which can be signaled by something as simple as answering a question correctly to something more complex like a point-based level system- they are deriving pleasure from the experience. Regardless of what decisions learners are making, constant feedback in the form of tracking or game-state changes inform the learner on where they stand and lays out the ways by which they can progress or maintain success.

iGrad: Financial Literacy Platform

The iGrad Financial Literacy Platform uses game based learning models to maximize engagement and go beyond content acquisition and mastery. The curriculum is designed to not only introduce and familiarize students with core concepts, but to encourage them to apply the new information to emulated, real-life financial experiences.

The curriculum is organized into 15 chapters, with each chapter built around core competencies and key terms, challenging & analyzing preconceptions, exercises that demonstrate financial capability and case studies that bring abstract financial concepts to life.

Built into the system are powerful reporting tools that track knowledge gain, content consumption and demographic data. Data can be analyzed from system-wide to individual progress, and are available online, on-demand.

Content and Delivery

Original videos, articles, infographics and other content are being added by the content team every day. Every user is given a personalized profile with content recommendations (relevant modules, articles and videos), dynamic courses and progress monitoring.

Each curriculum is customized to fit the needs of each student and come ready with interactive, video-based models on financial core competencies, student loans, easy-to-grade assessments and more.

Features also include student loan balance reminders, FAFSA tutorials, scholarship assistance, repayment calculators, job search engine with resume analyzer and cover letter assistance, and personalized federally compliant Entrance & Exit Counseling courses.

|

||||||||||||||||||||

|