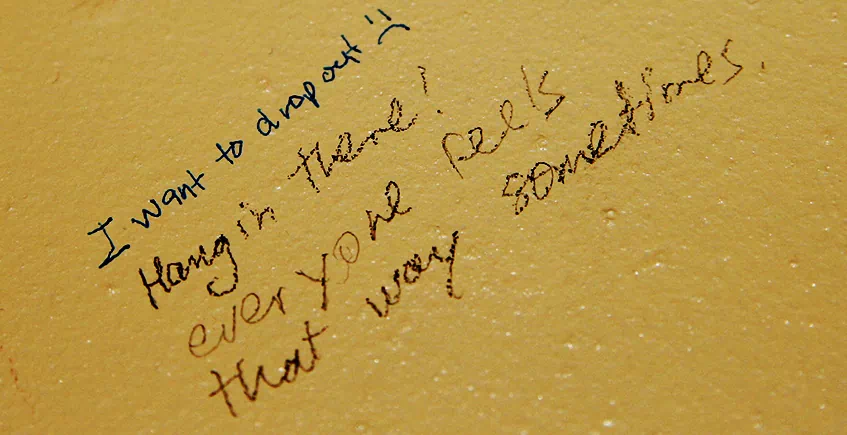

Photo Courtesy of: Quinn Dombrowski

The National Center for Education Statistics reported that about 41% of students who enrolled in college in the Fall of 2007 did not finish their degree within 6 years. Other studies have reported 30% of Freshman do not complete their first year or return for their second. Students who drop out face higher unemployment rates, earn less income on average and have higher loan default rates than their graduating counterparts.

According to a survey by the Bill and Melinda Gates Foundation, 71% of respondents said work contributed to their decision to drop out, with over half citing it as a major factor. The students dropping out of school for financial reasons are the ones that could benefit the most by earning a degree looking to double their lifetime income and have lower rates of unemployment.

While many factors play into students dropping out of college before completing their degree, financial wellness programs look to provide students with the tools and concepts they need to improve their financial decision making, and stay in school where financially feasible.

The Cost of Attrition

Students dropping out of college impacts their overall quality of life, the economy, and the college they attended. The attrition rate is the term used for the amount of money higher education institutions lose due to dropouts. It is calculated by multiplying the full time credit count by the per credit rate.

Ex: 12 credits X $200 = $2,400 in tuition each semester

Ready to bring iGrad to your school? Schedule a demoOver 3 million freshmen are projected to enroll in a college or university for the first time in 2016. A school enrolling 1,000 new full-time students would gross $2.4 million per semester.

Ex: $2,400 tuition X 1,000 students = $2.4 million

If 300 freshmen drop out, and 150 of them leave for financial reasons, the institution has a gross loss of $2,160,000 over three years. With a financial literacy training program enabling 15 of those 150 students to stay, the institution would have saved $216,000.

It’s hard to argue against those numbers. Even if you invest $100,000 into a financial literacy program and only retain 5% of those students, you’re still coming out on top. And who wouldn’t want improved retention rates?

By improving graduation rates through a financial literacy program, schools not only increase their gross revenue, but they help increase their graduate’s earning potential and improve their financial decision making.